arizona estate tax return

31 2021 can be prepared and e-Filed now along with your Federal or IRS Income Tax Return or you can learn how to complete and file only an AZ state return. Arizona residents who have a sufficient estate within the state or other states.

Attorneys personal representatives or fiduciary of a trust or estate can request a Certificate of Taxes from Arizona Department of Revenue based on any of the following.

. If you are presently a US Legal Forms consumer log in to your profile and click on the Download button to have the Arizona Fiduciary - Estate or Trust - Tax Return Engagement Letter. Monroe Room 610 Phoenix AZ 85007. The estate and gift tax exclusion amounts were increased to 5490000.

The estate or trusts gross income for the tax year is. To claim this credit the total amount repaid during the current tax year must be more than 3000. Prepare your docs in minutes using our simple step-by-step instructions.

For estates of resident and nonresident decedents with date of death on or after January 1 1980. Because Arizona conforms to the federal law there is. As of 2006 Arizona no longer levies an estate tax.

While Arizona does not levy a state estate tax some states do impose estate tax. 117 million for decedents who died in 2021 1206 million in 2022 or 2. Fill in the empty areas.

Fees paid to executors and administrative costs incurred in the settling of the estate are also deductible. Several of our CPAs are members of the Southern Arizona Estate Planning Council and the Central Arizona Estate Planning Council and attend national estate planning forums. Arizona does not impose an estate tax on a decedents estate.

Fiduciary and Estate Tax. Change the template with exclusive fillable fields. With this document the trust can deduct interest it distributes to beneficiaries from its overall taxable income.

We complete over 600 trust returns Form 1041 on behalf of clients every year and we do 5 to 10 estate tax returns Form 706 annually. This exemption rate is subject to change due to inflation. Complete and mail to.

So if an estate includes real property located in another state the state. Arizona Estate Tax. The annual exclusion for gift taxes remains at 14000.

Arizona Estate and Inheritance Tax Return Engagement Letter - 706 FAQ Do all estates have to file Form 706. 20 rows Arizona Fiduciary Income Tax Return. 2017 Estate and Gift Tax Law Changes.

However there are two situations in which an estate may still owe estate tax. Additionally the trust must file a Form 1041 which reports income capital gains deductions and losses. The value of the estate exceeds 20000 at time of death.

Even though Arizona does not have its own estate tax the federal government still imposes its own tax. The estates Arizona taxable income for the tax year is 1000 or more. If you own property in those states or have heirs who live in one of those states your estate and their inheritance may be subject to taxation.

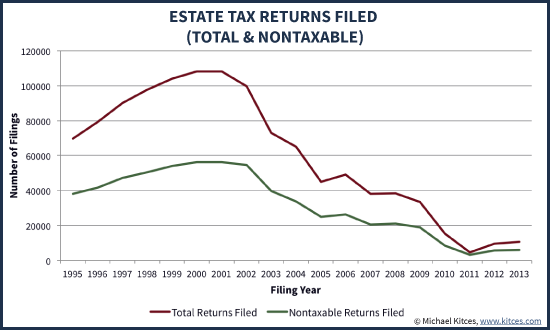

The certificate request should be mailed to. The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return. Federal law eliminated the state death tax credit effective January 1 2005.

All estates in the United States that are worth more than 549 million as of 2017 are required to pay an estate tax. IRAs and other retirement accounts can create different tax issues. Find the Arizona Inheritance Tax Waiver Form you require.

But there are states that do impose a state-level estate tax. Income tax return filed by a. Identify the return you wish to check the refund status for.

The estate has a beneficiary that is not an Arizona resident. How does the estate tax work. 14 rows Arizona Fiduciary Income Tax Return.

The trusts Arizona taxable income for the tax year is 100 or more. Arizona estate tax exemption. Arizona Department of Revenue 1600 W.

In fact there are no forms or filing requirements to notify Arizona of your estate at all. Form 706 must be filed by the executor of the estate of every US. Fields marked with are required.

Use US Legal Forms to find the Arizona Fiduciary - Estate or Trust - Tax Return Engagement Letter with a number of click throughs. 2016 Estate and Gift Tax Law Changes. Check Refund Status can only be used for tax returns filed after December 31st 2007.

The estate and gift tax exclusion amounts were increased to 5450000. 2018 Estate and Gift Tax Law Changes. Estate Tax Unit Arizona Department of Revenue 1600 West Monroe Room 520 Phoenix AZ 85007-2650.

The annual exclusion for gift taxes remains at 14000. Whose gross estate adjusted taxable gifts and specific exemptions total more than the exclusion amount. Estate tax is a tax imposed on and payable by a decedents estate.

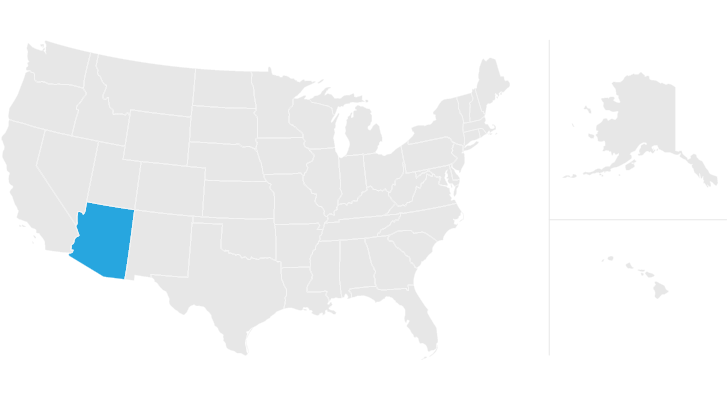

Concerned parties names addresses and phone numbers etc. The estate tax is assessed upon certain states when a person has passed away. Arizona is one of 38 states that does not assess an estate tax.

Arizona Estate Tax Return. Check Refund Status can only be used for tax returns filed after December 31st 2007. Learn Arizona tax rates for property sales tax to estimate how much youll pay on your 2021 tax return.

Form is used by a Fiduciary to compute a tax credit under Arizonas Claim of Right provisions by identifying an income amount previously reported by the estate or trust that was required to be repaid during the current taxable year and the associated tax that was paid on that income. Open it with online editor and begin altering. The current federal estate tax is currently around 40.

Arizona state income tax rates range from 259 to 450. If needed the personal representative should request the tax release certificate when filing the final income tax return for the estate. It is often referred to as the death tax.

Fiduciary and Estate Tax.

How To File Llc Taxes Legalzoom Com

As Per The Definition Tax Preparation Is The Process Of Having Your Returns Prepared Ahead Of Tax Preparation Income Tax Preparation Tax Preparation Services

Quit Telling Yourself Lies Do You Really Know How Much It Costs To Buy A Home Most Clients Have No Idea Which Isnt A Bad Thin Home Buying Tax Refund You

Free Resources Are Available For You To Use As A Courtesy From The Staff At Family Tree Estate Planning Please Review Estate Planning Family Tree Tax Forms

Tax Form Templates 5 Free Examples Fill Customize Download

How To File Taxes For Free In 2022 Money

New Irs Requirements To Request Estate Closing Letter

Don T Normally File A Tax Return You May Be Due A Credit A Refund Nonetheless

Deducting Property Taxes H R Block

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Arizona Estate Tax Everything You Need To Know Smartasset

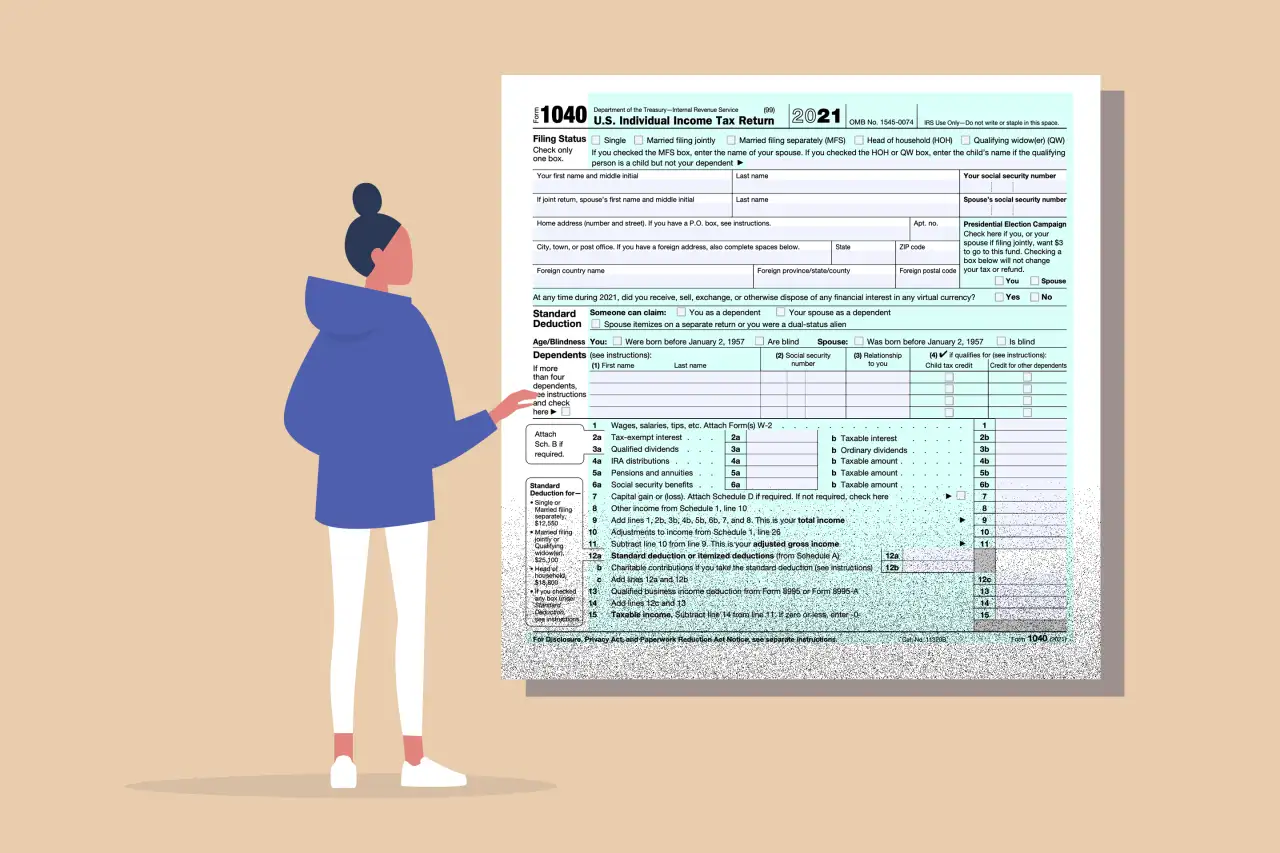

Complete Your 2021 Arizona And Irs Taxes Now On Efile Com

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

Us Tax Form 1040 Filing Taxes Tax Ameriprise Financial

Average Tax Refund Climbs To 3 034 So Far This Year Tax Refund Income Tax Return Income Tax